Buying Servers in 2026: Tips on Surviving RAM and SSD Price Spikes

December 19, 2025 · Matt p

As RAM and SSD prices surge, is there anything we can do to keep a handle on server costs next year?

The Price Volatility Landscape

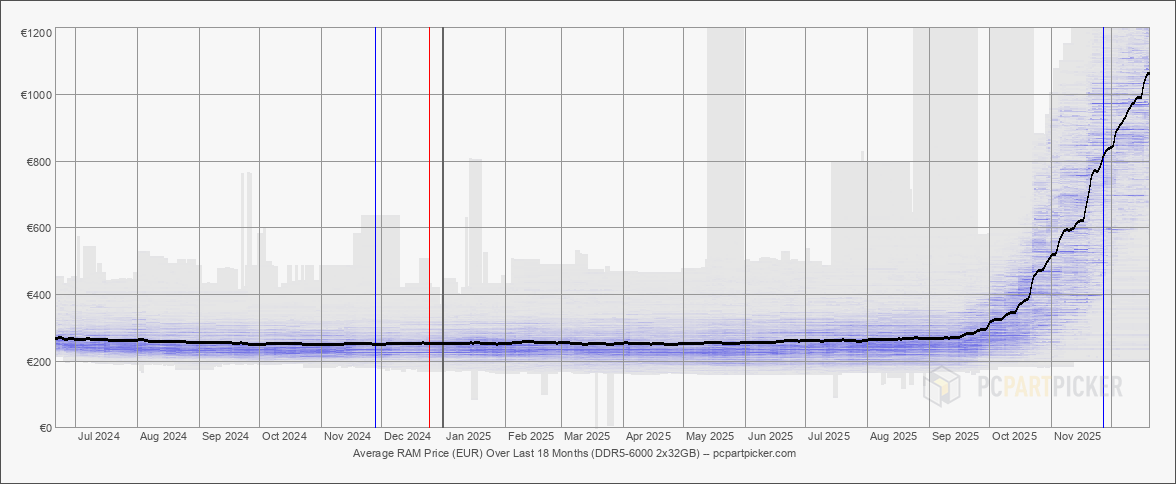

NAND flash contract prices surged over 60% in November 2025 [2]. High-density DDR5 modules (64GB kits) nearly quadrupled from September to December 2025 [8]. TrendForce revised its 4Q25 DRAM forecast from 8-13% to 18-23% growth due to strong CSP demand [1].

AI data center demand is driving these increases. Industry forecasts indicate continued upward pressure in server DRAM pricing into 2026, in part driven by supplier focus on higher-margin products [1]. Similarly, Enterprise SSD demand is driving 1Tb TLC shortages [2]. Manufacturers are struggling to scale production, with Micron indicating it can only meet 50-66% of (main) customer demand [3].

The Vendor Pricing Lag Problem

Different vendor types respond to component cost changes at different speeds.

Component Markets: Rapid Price Updates

Component markets respond to price changes in near real-time. When NAND wafer prices increase, component prices adjust within weeks.

Inventory holders with existing stock may not realize their inventory value has increased. If they purchased at lower prices, they may still quote based on original cost rather than current replacement cost. This creates short windows to purchase before they adjust pricing.

Server Vendors: Pricing Lag

Server vendors adjust pricing on quarterly or annual schedules, creating lag:

- Price increases may lag behind actual component cost increases by months

- Price decreases may be delayed even longer

- Customers may experience sudden, large price adjustments when vendors finally update

- Vendors may absorb cost increases temporarily before passing them to customers

This creates a window where server costs have increased but vendor pricing hasn't updated yet. Purchase during this window to lock in lower rates before vendors adjust.

Procurement Strategies

1. Pre-Qualify Substitutions

Define acceptable alternatives upfront:

- Memory: Define acceptable DIMM capacities, ranks, speeds, and approved part families.

- SSD: Define endurance (DWPD), sustained write behavior, firmware policy, and form factor. Pre-approve 2 to 3 options [7].

2. Structure Buys to Protect Schedule

- Staged purchase orders: Place an initial tranche to start deployment, then monthly releases tied to build slots.

- Quote validity and price protection: Negotiate a clear validity window and a mechanism for changes (caps, indexed adjustments, or hold price for delivered units).

- Allocation visibility: Ask vendors what is allocated (DIMMs, SSDs, NICs) and what is not. Treat best-effort allocation as schedule risk.

3. Monitor Vendor Announcements

Vendor earnings calls and press releases contain early pricing signals [3], [4]. When vendors announce future increases, lock in current rates immediately or through longer-term contracts.

4. Obtain Multiple Vendor Quotes

Vendors update pricing at different times. Get quotes from multiple sources. Those that haven't updated yet may offer lower quotes, but these windows close quickly.

5. Explore Alternative Procurement Channels

- Smaller regional distributors: May still have inventory at older rates due to less sophisticated pricing systems.

- Cross-territory procurement: Import from regions where pricing hasn't caught up. Factor in duties and shipping, but price deltas can justify it.

- Specialized component resellers: Focus on specific categories (memory, storage) and may have better inventory visibility or excess stock.

- Direct manufacturer relationships: For larger deployments, go directly to component manufacturers for better pricing and allocation visibility.

Cost Optimization and Timing

Right-Size Configurations

Stop defaulting to max RAM per socket. Use telemetry to evaluate actual requirements:

- Don't over-provision RAM "just in case" it's now significantly more expensive

- Evaluate actual storage needs vs. peak requirements

- Keep boot drives small and redundant. Spend SSD budget where it impacts workload

- Prefer scale-out when it fits: if the workload scales horizontally, smaller nodes can reduce per-node memory requirements

What to Monitor

Track these sources for early signals:

- TrendForce DRAM and NAND outlook [1], [2]: Direction, supply notes, and contract market commentary

- Supplier earnings releases [3], [4]: Early signals about pricing changes and allocation behavior

- Quote behavior: Shorter validity, tighter substitution rules, and longer lead times usually show up before list prices

- Component distributor pricing: Often leads server vendor price changes by weeks or months

Worked Examples

Here are real examples of good value purchases found using the strategies outlined above. Note: These are snapshots as of the time of writing this article (December 2025) and are provided as examples only. Prices and availability may have changed since publication.

Example 1: 6.4TB NVMe SSD

Western Digital Ultrastar DC SN840 — 6.4TB NVMe SSD with 5-year warranty and 3DWPD endurance rating.

- Capacity: 6.4TB

- Endurance: 3DWPD (Drive Writes Per Day)

- Warranty: 5 years

- Price: £349.99 ex-VAT (£419.99 incl VAT)

- Link: Western Digital Ultrastar DC SN840 6.4TB

Tips used: Buying from a consumer retail site where price updates haven't filtered through, older stock, direct manufacturer sales.

Example 2: DDR5 Server Memory

Micron DDR5 Registered ECC Memory — 32GB DIMM module suitable for server deployments.

- Capacity: 32GB

- Type: DDR5, DIMM 288-pin

- Speed: 6400 MHz / PC5-51200

- Timings: CL52

- Voltage: 1.1V

- Features: Registered, ECC

- Part Number: MTC20F1045S1RC64BD2R

- Price: £215.99 ex-VAT (£259.19 incl VAT)

- Link: Micron DDR5 32GB Registered ECC Module

Tips used: Regional distributor with inventory at competitive rates, direct manufacturer part (Micron Technology).

Key Takeaways

- Pricing lag creates purchase windows: Server vendors and inventory holders adjust pricing slower than component markets, creating opportunities to lock in lower rates before they update.

- Monitor component prices for early signals: Track DRAM and NAND pricing trends to anticipate when vendors will adjust server pricing, often weeks or months in advance.

- Vendor announcements provide lead time: Earnings calls and press releases signal future price increases months ahead, giving time for strategic purchases.

- Get multiple quotes: Different vendors and inventory holders update pricing at different times, creating opportunities to find better rates.

- Right-size configurations: Use telemetry to evaluate actual requirements rather than defaulting to maximum specs, reducing exposure to volatile component pricing.

- Pre-qualify substitutions: Define acceptable alternatives upfront for memory and storage to maintain flexibility when prices spike.

Start by monitoring component prices, setting up vendor quote processes, and evaluating immediate purchase opportunities when pricing windows open.

References

- TrendForce, server DRAM outlook↑(October 29, 2025)Revised 4Q25 forecast for conventional DRAM pricing from 8-13% growth to 18-23%, driven by strong CSP demand and data center expansion. https://www.trendforce.com/presscenter/news/20251029-12758.html

- NAND Flash wafer supply tightens↑(November 2025)Contract prices surged over 60% in November 2025, with 512Gb and 1Tb TLC segments rising more than 65%, driven by AI workloads and enterprise SSD demand. https://www.tomshardware.com/tech-industry/nand-wafer-shortage-pushes-november-contract-prices-up

- Micron, DRAM supply outlook↑(December 2025)CEO Sanjay Mehrotra indicated the company can only meet 50-66% of demand from key customers, with supply constraints expected to persist beyond 2026. https://www.tomshardware.com/pc-components/dram/micron-outlines-grim-outlook-for-dram-supply-in-first-earnings-call-since-killing-crucial-memory-and-ssd-brand-ceo-says-it-can-only-meet-half-to-two-thirds-of-demand

- Dell, commercial client price increases↑(December 2025)Reports indicate Dell is preparing price hikes for commercial clients, with increases affecting devices with higher memory and storage configurations, citing global DRAM and NAND chip shortages. https://www.techradar.com/pro/dell-reportedly-preparing-massive-price-hikes-for-commercial-clients-and-warns-ordering-today-for-future-delivery-does-not-lock-in-current-pricing

- SNIA NVMe SSD classification white paper↑

- PCPartPicker, DDR5 64GB kit price trends↑(December 2025)Price trend chart showing high-density DDR5 64GB (2x32GB) kit prices nearly quadrupling from approximately €250-€280 in September 2025 to over €1000 by November 2025. Chart source: https://nl.pcpartpicker.com/trends/price/memory/#ram.ddr5.6000.2x32768